How Supply-Side Economics and the Laffer Curve Drive Small Business Success

Understanding the Arthur Laffer Curve and It’s Impact on Maximizing Small Business

Arthur Laffer, a prominent economist, revolutionized our understanding of how taxes, regulation, and investment influence economic growth with his famous Laffer Curve. While often discussed in the context of national policy, Laffer’s insights are equally powerful for small businesses. His ideas help business owners move beyond guesswork, enabling them to make informed decisions that maximize success and benefit their customers. In this blog, we’ll explore how the principles of supply-side economics and the Laffer Curve apply directly to small business operations, offering practical guidance for both owners and customers.

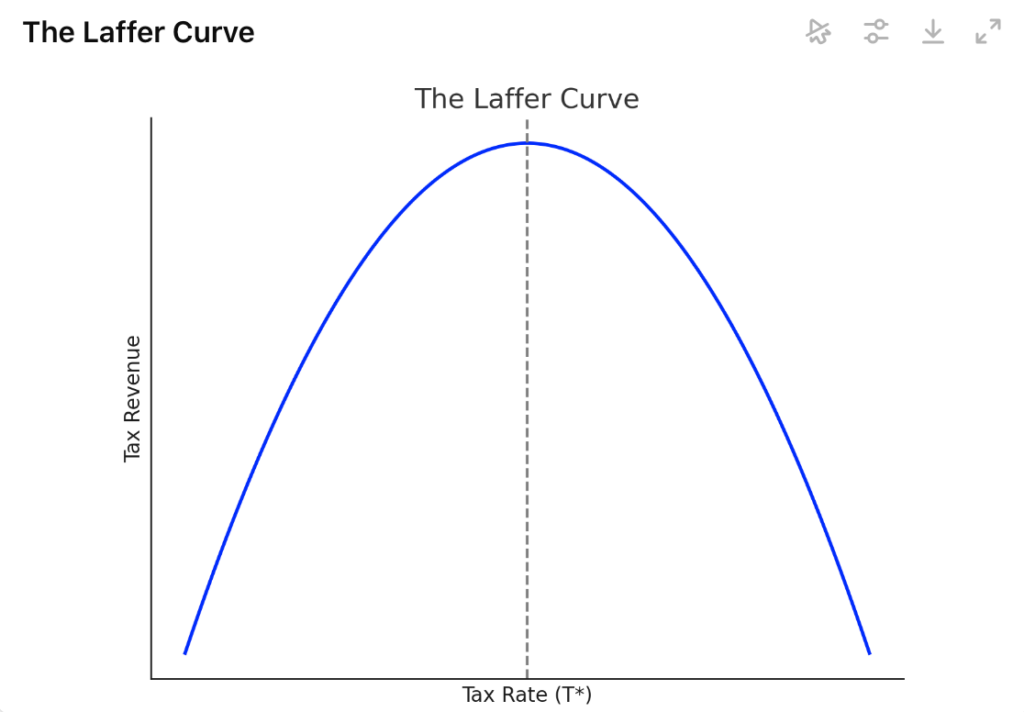

What is the Laffer Curve?

Before diving into its application, it’s important to understand the Laffer Curve. The Laffer Curve graphically illustrates the relationship between tax rates and tax revenue, showing that there’s an optimal tax rate where revenue is maximized. Beyond this point, higher taxes actually reduce revenue by discouraging economic activity. This concept is critical for small businesses as it underscores the importance of finding balance in all areas of operation—taxation, regulation, investment, and workforce management.

1. Tax Reduction: The Laffer Curve in Action

Business Perspective: The Laffer Curve demonstrates that lowering taxes can lead to increased economic activity, which in turn boosts overall tax revenue—up to a certain point. For small business owners, lower taxes mean more capital to reinvest in their business. This could involve expanding product lines, enhancing customer service, or investing in new technology—all of which improve the customer experience.

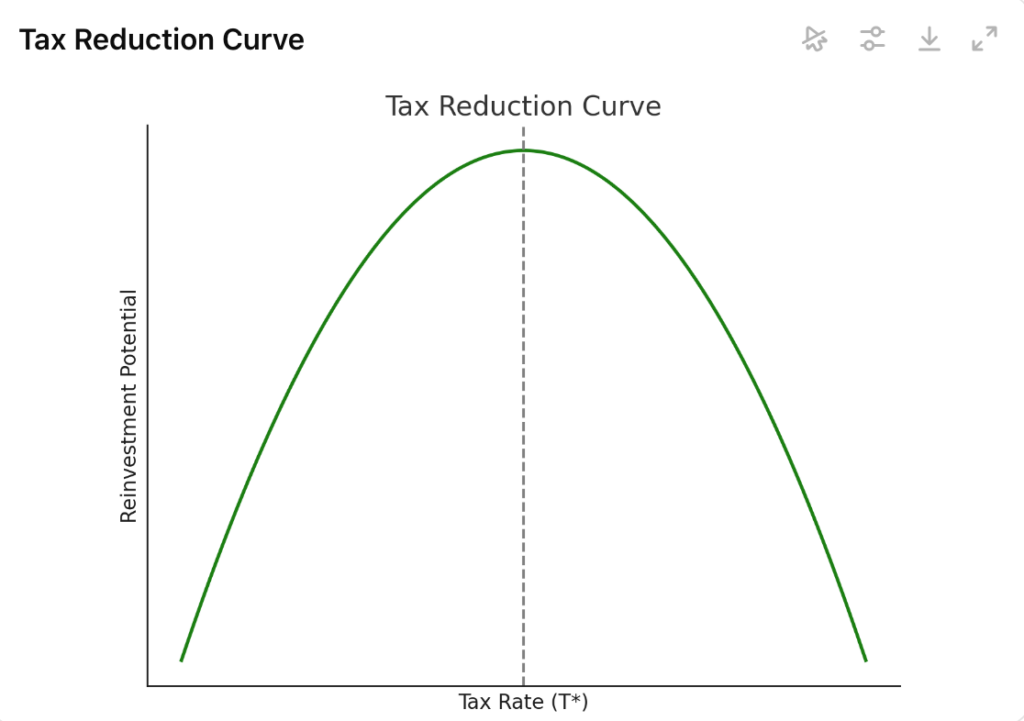

Application of the Laffer Curve: Below is a custom Laffer Curve showing the relationship between tax rates and reinvestment potential for small businesses. The optimal point indicates where businesses can maximize reinvestment while still contributing to government revenue.

Customer Connection: When businesses grow and improve their offerings due to optimal tax rates, customers benefit from better value. Increased competition among businesses to attract customers drives prices down and quality up, creating a win-win situation for both parties.

2. Deregulation: Flexibility and Economic Activity

Business Perspective: Excessive regulation can stifle a small business’s ability to adapt and innovate. Laffer’s supply-side economics suggests that there is an optimal level of regulation—just as with taxes—where enough oversight ensures fairness without hindering growth. Reducing unnecessary regulations allows businesses to operate more efficiently and respond more quickly to customer needs.

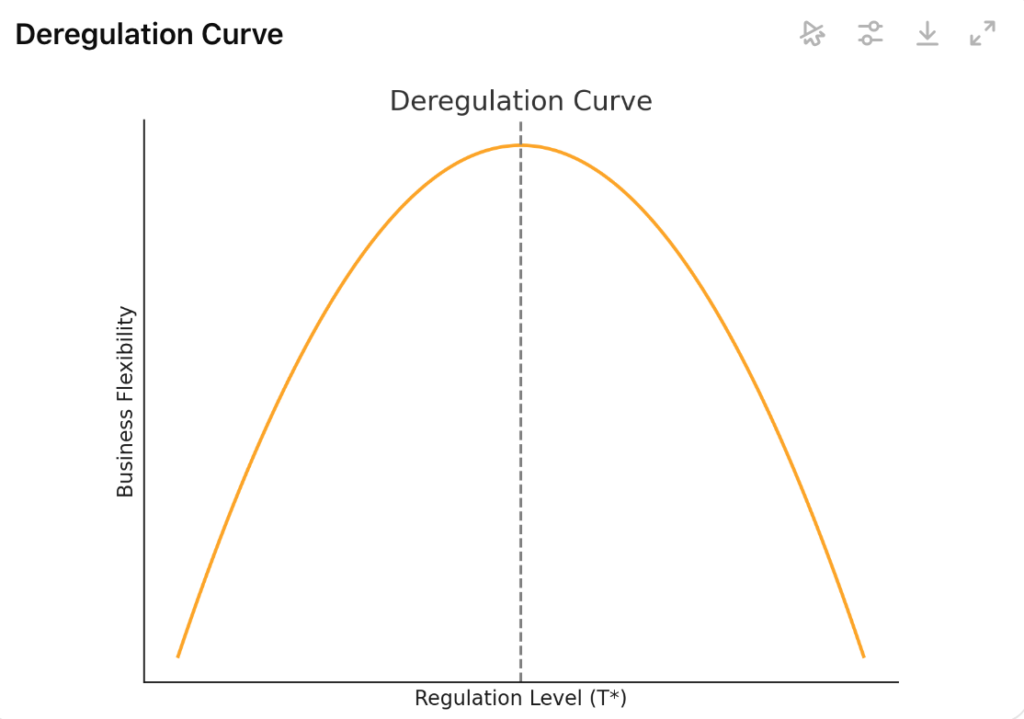

Application of the Laffer Curve: The curve below represents how different levels of regulation impact business flexibility and innovation. The optimal point shows the balance between necessary regulation and the freedom needed for businesses to thrive.

Customer Connection: For customers, deregulation means quicker access to innovative products and services that better meet their needs. When businesses can operate without excessive regulatory burdens, they are more agile and responsive, leading to a better customer experience.

3. Capital Investment: Building with the Laffer Curve in Mind

Business Perspective: Supply-side economics encourages businesses to invest in capital—whether in technology, infrastructure, or their workforce. The Laffer Curve concept suggests that there is an optimal level of investment where businesses can maximize productivity and profitability without overextending their resources.

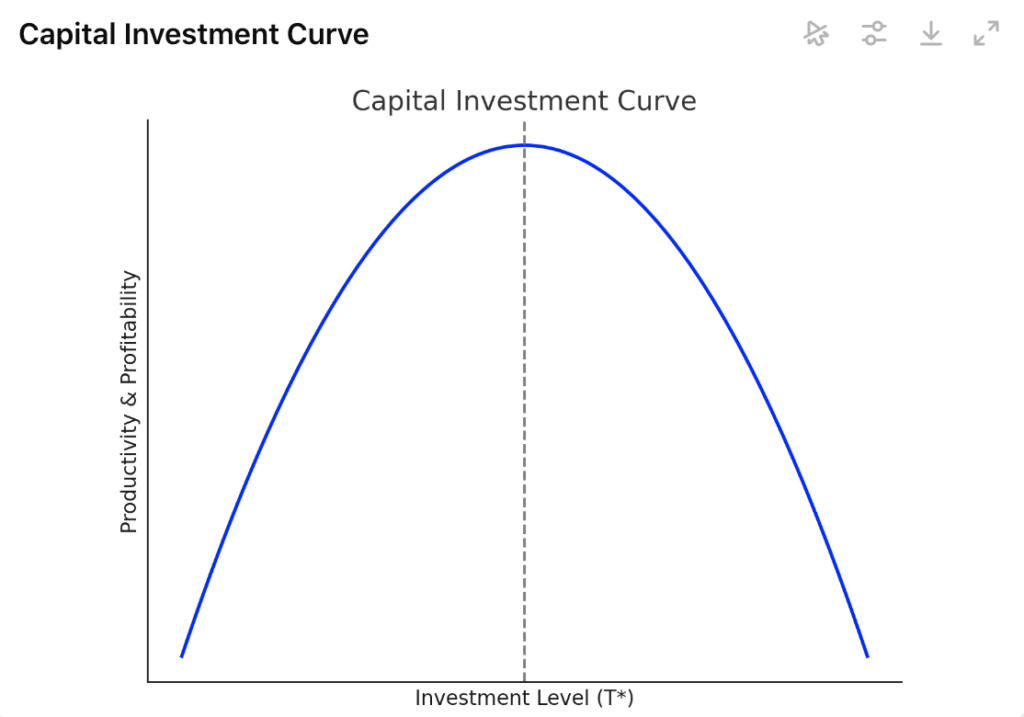

Application of the Laffer Curve: Here’s a custom Laffer Curve illustrating the relationship between capital investment levels and productivity/profitability. The optimal point reflects the level of investment that maximizes returns without diminishing resources.

Customer Connection: Customers benefit when businesses invest in their future. Whether through better technology, more efficient production processes, or enhanced customer service, these improvements lead to higher quality products and a superior overall experience.

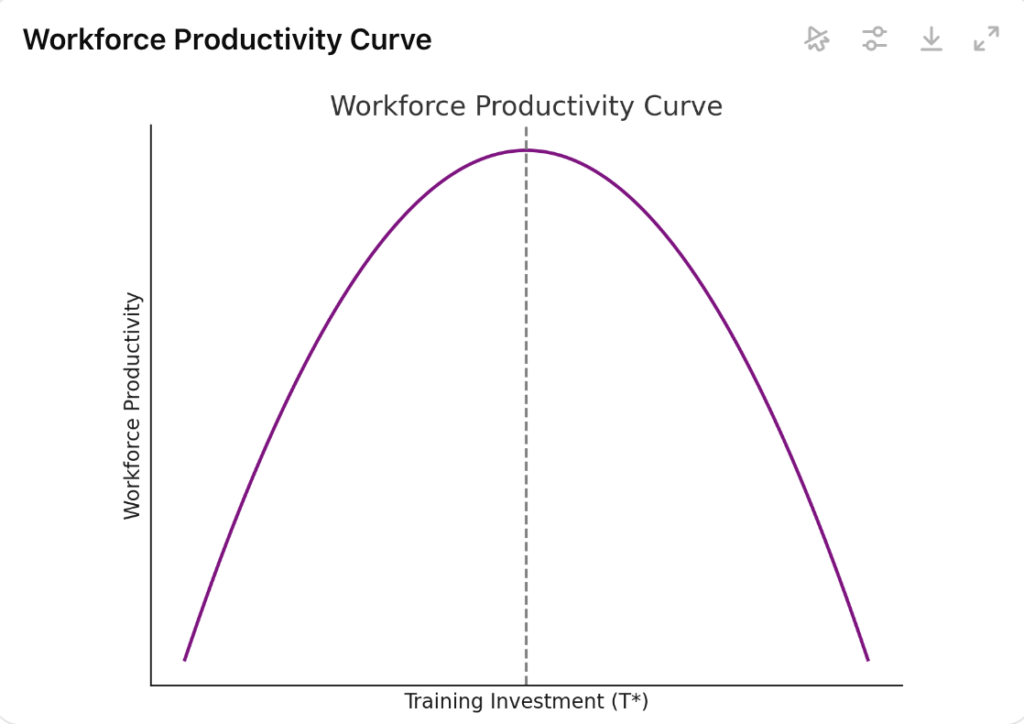

4. Workforce Productivity: The Laffer Curve and Human Capital

Business Perspective: Laffer’s principles also extend to workforce management. Just as businesses are more productive when they are not overtaxed, employees are more productive when they are well-compensated and motivated. Investment in employee training and development can significantly enhance productivity, improving the business’s offerings.

Application of the Laffer Curve: Below is a Laffer Curve showing the relationship between investment in workforce productivity (such as training) and the resulting productivity gains. The optimal point indicates the level of investment that maximizes productivity without diminishing returns.

Customer Connection: A well-trained, motivated workforce translates into better customer service and higher-quality products. When employees are equipped with the right skills and knowledge, they better meet customer needs and provide a superior experience, reinforcing customer loyalty and satisfaction.

Clarification on the Laffer Curve:

- Laffer Curve Concept: The Laffer Curve demonstrates that there is an optimal tax rate somewhere between 0% and 100%, where tax revenue is maximized. The exact point on the curve where this optimal rate lies is not fixed and can vary depending on the specific economic conditions, the structure of the tax system, and other factors.

- No Fixed Optimal Rate: Laffer himself did not claim a specific percentage as the optimal tax rate. Instead, his work emphasizes the concept that both extremely low and extremely high tax rates can lead to lower revenue, with the actual optimal rate being a point of debate and analysis.

Open Ended Style of the Laffer Curve

- Tax Reduction Curve: Represents the relationship between tax rates and reinvestment potential in small businesses.

- Deregulation Curve: Illustrates the impact of regulation levels on business flexibility and innovation.

- Capital Investment Curve: Depicts the relationship between levels of capital investment and productivity/profitability.

- Workforce Productivity Curve: Shows how investment in workforce training affects overall productivity.

Conclusion: Laffer Curve Economics for Small Business Success

Arthur Laffer’s work on the Laffer Curve has had a profound impact on economic theory, demonstrating the importance of balance in taxation, regulation, and investment. For small business owners, these principles are more than just theoretical—they are practical tools for achieving success. By applying Laffer’s insights, business owners can move beyond guesswork, making strategic decisions that benefit both their business and their customers. The result is a thriving, efficient business that consistently delivers value, fostering long-term customer relationships.

Final Thought: Embrace the Laffer Curve for Sustainable Growth

Laffer’s principles show that balance is key. Whether it’s in taxes, regulation, or investment, finding the optimal point can lead to greater success for your business and a better experience for your customers. By integrating these insights into your business philosophy, you can create a more predictable, stable, and prosperous environment.

Call to Action: Maximize Your Business Success with Raven Business Coaching

At Raven Business Coaching, we help small businesses apply the principles of supply-side economics to achieve their goals. Our tailored subscription plans provide the tools and guidance you need to navigate challenges and thrive in a competitive market. Whether you’re looking to optimize your tax strategy, reduce regulatory burdens, or invest in your workforce, we’re here to help.

What to do with what you have.

Ready to shine in the online sphere? Raven Business Coaching is here for you. Visit us at Raven Business Coaching – “run and not grow weary”.

Reference Links:

- How to Streamline Business Administration

- Effective Sales Strategies for Small Businesses

- Innovative Product Development Techniques

- Streamlining Operations for Small Businesses

- Cash Flow Management Tips

Explore our subscription plans today and take the first step toward building a stronger, more resilient business.

Raven Business Coaching: Crafting Small Business Success

At Raven Business Coaching, we understand the unique challenges faced by construction contractors, especially those operating as solo entrepreneurs. Our tailored subscription plans are designed to help you navigate these challenges and achieve long-term success.

- Essential Business Subscription: This plan provides the foundational tools and guidance you need to manage your business effectively, improve client relations, and maintain a strong market presence.

- Comprehensive Business Subscription: For contractors ready to take their business to the next level, this plan offers advanced strategies for scaling your operations, optimizing workflow, and maximizing profitability.

Peace on your Days

Lance